5 Reasons Why Revolut Business Is Perfect for UK Business Owners

Stop wasting money on outdated banking. Here's why over 500,000 UK businesses have made the switch.

Zero Banking Fees

Traditional banks charge £500+ yearly in fees. Revolut Business gives you everything for free. This isn't just about saving money - it's about freeing up capital that can be reinvested back into growing your business. Every pound saved on banking fees is a pound that can go towards marketing, inventory, or hiring your next team member.

Other banks charge:

- • £5-15/month fees

- • £0.20-0.35 per payment

- • £15-30 international transfers

Revolut Business gives FREE:

- • £0 monthly fees forever

- • 1000+ free payments monthly

- • Virtual & physical cards

- • 28+ currencies + crypto

Save £500+ yearly by switching from traditional banking fees.

Start Saving Now →Instant Global Payments

Move money globally in minutes, not days. Pay suppliers same-day instead of waiting a week. In today's fast-paced business environment, cash flow timing is everything. The ability to process international payments instantly gives you a competitive edge, allowing you to secure better supplier terms and take advantage of time-sensitive opportunities.

Traditional banks:

- • 3-5 day transfers

- • £15-30 fees + poor rates

- • Hidden charges

Revolut Business:

- • Instant to minutes

- • Transparent low fees

- • Interbank rates in 28+ currencies

Case Study: Sarah's e-commerce business saved £1,500+ yearly on international transfers and improved supplier relationships with same-day payments.

Get Instant Transfers →Ready to Save £500+ This Year?

Join 500,000+ UK businesses already using Revolut Business

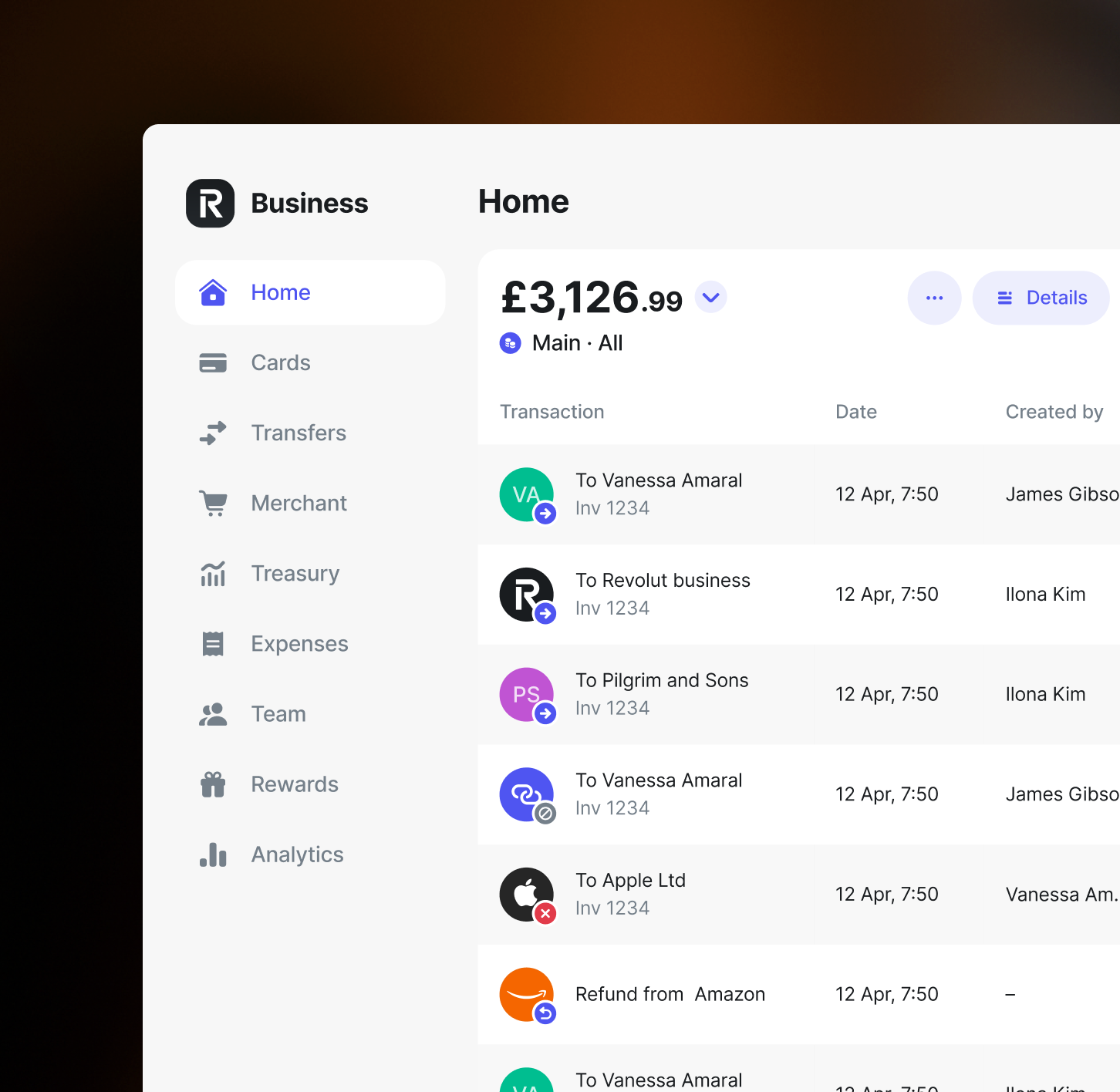

Open Free Account →Smart Financial Insights

Automatic expense tracking and real-time analytics. See exactly where your money goes. Data-driven decision making is crucial for business success. With detailed spending insights at your fingertips, you can identify cost-saving opportunities, optimize your budget allocation, and make informed financial decisions that drive profitability.

Smart Features:

- • Real-time spending analytics

- • Automatic expense categorization

- • Budget alerts & limits

Auto-Sync:

- • Xero, QuickBooks, FreeAgent

- • Automatic VAT calculations

- • Instant expense reports

Save 10+ hours weekly on bookkeeping with automatic sync to your accounting software.

Get Smart Insights →Open in 10 Minutes

Skip weeks of waiting. Get approved instantly and start banking immediately. Time is money in business, and waiting weeks for bank account approval means delayed operations, missed opportunities, and frustrated customers. With instant approval, you can start trading, accepting payments, and managing your finances from day one.

Traditional banks:

- • 3-4 weeks approval

- • Branch appointments required

- • Mountains of paperwork

Revolut Business:

- • 10 minutes sign up & 24 hour approval

- • 100% digital process

- • Virtual cards instantly

Just need: Business registration, director ID, proof of address. Done on your phone.

Start Now →Perfect for Small Business & Young Entrepreneurs

Designed specifically for the next generation of business owners. Whether you're a 22-year-old launching your first startup or a small business scaling up, Revolut Business gives you enterprise-level financial tools without the complexity or cost. Crypto trading, virtual cards, and smart automation level the playing field against bigger competitors who've had these advantages for years.

What small businesses usually get:

- • Basic business accounts

- • Limited digital tools

- • Enterprise features cost extra

What you get with Revolut:

- • Enterprise-level features for free

- • Built for digital-first businesses

- • Everything young entrepreneurs need

Startup-friendly: Young entrepreneurs get crypto trading, professional invoicing, and enterprise tools that typically cost thousands - all for free.

Join Fellow Entrepreneurs →Virtual Cards: The Future of Business Payments

Control your business spending like never before with instant virtual cards that you can create, freeze, and delete on demand.

Perfect for recurring subscriptions

Create dedicated virtual cards for each software subscription, marketing platform, or online service. Set exact spending limits and instantly see which services are costing you the most.

- • Separate card for each subscription

- • Set custom spending limits

- • Instant freeze if suspicious activity

- • Easy cancellation without changing main card

Employee expense control

Issue virtual cards to team members with predefined budgets and spending categories. No more expense reports - everything is tracked automatically.

- • Individual cards for each team member

- • Category restrictions (meals, travel, supplies)

- • Real-time spending notifications

- • Automatic receipt capture

Why virtual cards are game-changers for business:

- • Create unlimited cards instantly

- • Set spending limits per card

- • Freeze/unfreeze instantly via app

- • Perfect for online advertising spend

- • Delete cards after one-time purchases

- • Track expenses by project or team

- • Enhanced security for online purchases

- • Automatic integration with accounting software

Beyond Banking: Crypto Trading & Professional Invoicing

Why juggle multiple platforms when Revolut Business handles your banking, cryptocurrency investments, and client invoicing all in one place?

Cryptocurrency Trading

Diversify your business treasury with 80+ cryptocurrencies. Buy Bitcoin, Ethereum, and altcoins directly from your business account with institutional-grade security.

Low Trading Fees

Trade crypto from 0.25% - much lower than traditional exchanges

Secure Storage

Enterprise-grade security with offline cold storage protection

Tax Reporting

Automatic crypto transaction reports for easy accounting

Business Strategy: Many forward-thinking businesses hold 5-10% of their treasury in Bitcoin as an inflation hedge and alternative investment.

Get Crypto Access →Professional Invoicing

Create, send, and track professional invoices directly from your business account. Accept payments in multiple currencies and get paid faster.

Multi-Currency Invoices

Invoice in GBP, EUR, USD, or any of 28+ supported currencies

Instant Payment Links

One-click payment links that work with any bank or card globally

Automated Tracking

Real-time payment notifications and automatic reconciliation

Cash Flow Boost: Clients pay 40% faster with embedded payment links vs traditional bank transfer instructions.

Get Paid Faster →Real Business Impact: Tom's Agency

Tom J runs a 6-person digital marketing agency in Manchester. Instead of juggling separate tools for banking (Lloyds), invoicing (FreshBooks), and crypto investing (Coinbase), he consolidated everything into Revolut Business.

- Banking fees £15/mo

- FreshBooks £29/mo

- Crypto fees 2.0%

- Time spent weekly6+ hours manual work

- Banking fees £0/mo

- Invoicing £0/mo

- Crypto fees 0.25%

- Time spent weekly2 hours automated

"Revolut Business saved us over £500 a year and 4+ hours weekly. The integrated platform just makes everything easier."

— Tom J, Digital Marketing Agency

Ready to Stop Overpaying for Banking?

Join over 500,000 UK businesses that have already made the switch. Open your free Revolut Business account in under 10 minutes.

The Numbers Don't Lie: Revolut vs Traditional Banks

| Feature | Revolut Business | Lloyds | Barclays | NatWest |

|---|---|---|---|---|

| Monthly Fee | £0 | £5.50 | £5.00 | £6.00 |

| Free Monthly Transactions | 1000+ | 40 | 50 | 35 |

| International Transfer Fee | From £0.50 | £15-30 | £15-25 | £20-30 |

| Account Opening Time | 10 minutes | 1-2 weeks | 1-2 weeks | 1-3 weeks |

| Multi-currency Accounts | 28+ currencies | Limited | Limited | Limited |

Annual savings with Revolut Business: £500-1k+ compared to traditional banking

Start Saving Today →Frequently Asked Questions

Stay Updated with Banking News

Get the latest business banking rates, financial tool reviews, and expert insights delivered to your inbox weekly.

We respect your privacy. Unsubscribe at any time.